interest tax shield meaning

The Interest Tax Shield refers to the tax savings resulting from the tax-deductibility of the interest expense on debt borrowings. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest Deduction As Mortgage Interest Mortgage.

Tax Shield Formula How To Calculate Tax Shield With Example

Companies pay taxes on the income they generate.

. Interest expenses via loan and. The deductible interest paid. For example because interest on debt is a tax-deductible expense taking on.

We also call this Interest tax shield. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. Related Entries of Interest Tax Shield in the Encyclopedia of.

The interest tax shield is positive when the EBIT is greater than the payment of interest. Interest tax shield refers to the reduction in taxable income which results from allowability of interest expense as a deduction from taxable income. Moreover this must be noted that interest tax shield value is the present value of all.

Interest tax shields refer to the reduction in the tax liability due to the interest expenses. The tax savings for the company is the amount. Meaning of Interest Tax Shield The reduction in income taxes that results from the tax-deductibility of interest payments.

That means the interest tax shields are risky and worth less than if the company followed Financing Rule 1. This can lower the effective tax rate. A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income.

A tax shield is the deliberate use of taxable expenses to offset taxable income. As interest expenditures are tax-deductible tax shields play. The tax shield arises from the deductibility of interest paid and increases the value for shareholders.

For example a mortgage provides an interest tax shield for a property buyer. Finance The reduction in income taxes that results from the tax-deductibility of interest payments. A suitably quantified value of the interest tax shield increases the value of.

The intent of a tax shield is to defer or eliminate a tax liability. Interest that a company pays on a loan or debt it carries on its balance sheet is tax-deductible. Interest expenses via loans and.

Interest payments are deductible expenses for most companies. Companies pay taxes on the income they generate. A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income.

For example a mortgage provides an interest tax shield for a property buyer because. Examples The value from the interest tax shield assumes the company is profitable. The payment of interest expense reduces the taxable.

The interest tax shield relates to interest payments exclusively rather than interest income. Interest tax shields refer to the reduction in the tax liability due to the interest expenses. The valuation of the interest tax shield capitalizes the total value of the firm and it limits the tax benefits of the debt.

Literature The projects APV is increased by the present value of interest tax.

The Interest Tax Shield Explained On One Page Marco Houweling

Pdf Is Tax Shield Really A Function Of Net Income Interest Rate Debt And Tax Rate Evidence From Slovak Companies

Tax Shield Meaning Importance Calculation And More

Risky Tax Shields And Risky Debt An Exploratory Study

Business In The United States Who Owns It And How Much Tax Do They Pay Tax Policy And The Economy Vol 30 No 1

Risky Tax Shields And Risky Debt An Exploratory Study

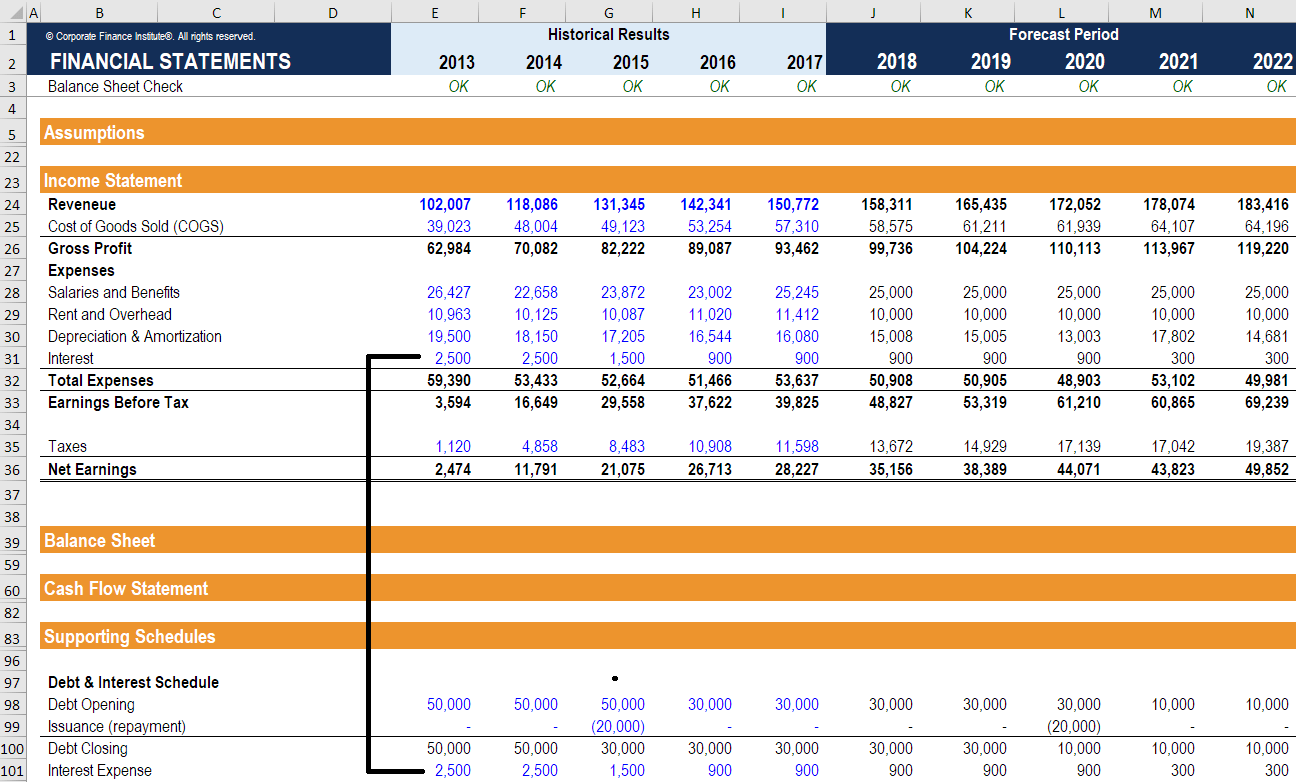

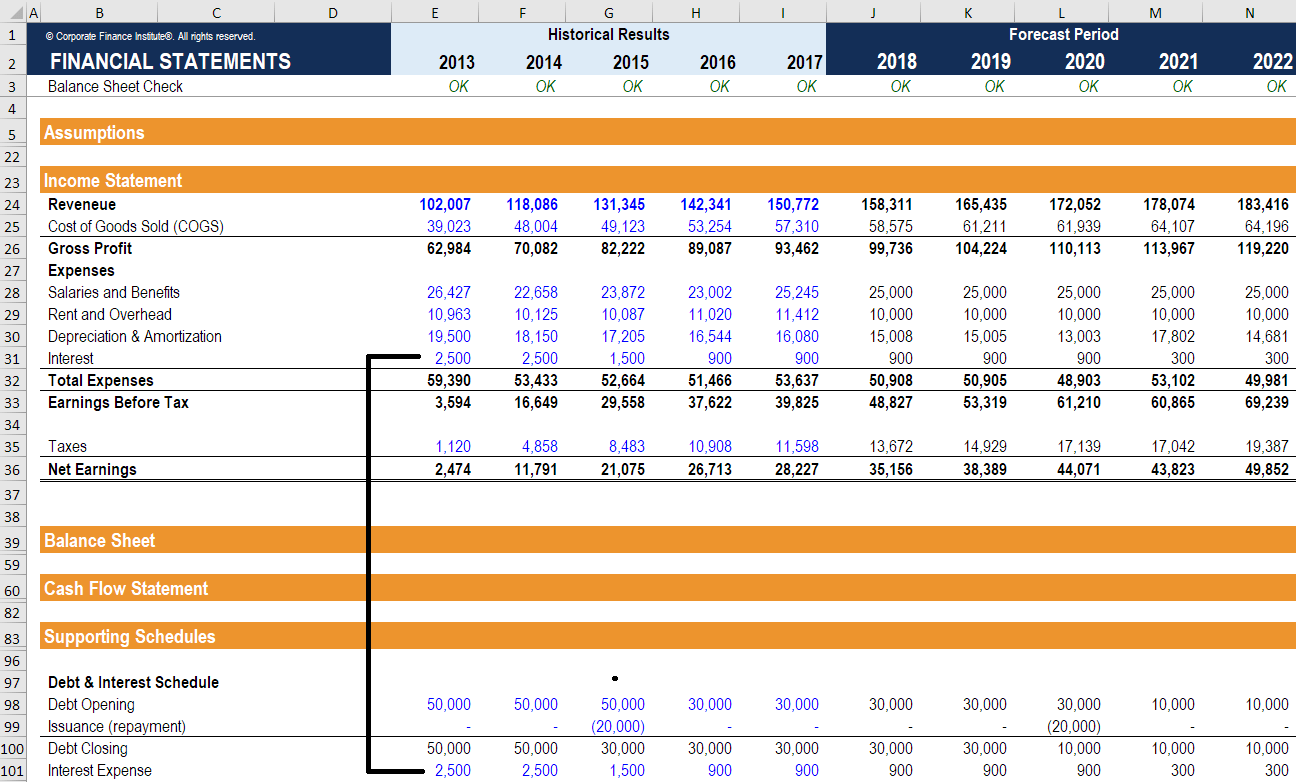

Interest Expense How To Calculate Interest With An Example

What Is The Mortgage Interest Deduction H R Block

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield In Cash Flow Analysis

Risky Tax Shields And Risky Debt An Exploratory Study

Berk Chapter 15 Debt And Taxes

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

The Trade Off Theory Of Capital Structure

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News